China biomedical industry research report

一. World medicine.

1. Rapid growth of global medicine.

Global pharmaceutical thanks to the main drug patent expires in succession and the rapid growth in emerging economies, has achieved rapid development in recent years, global pharmaceutical sales exceed 1.1 trillion yuan in 2016, 2011-2016 annual compound growth rate reached 6%. Emerging economies, representing the developing world, have seen their share of the pharmaceutical market rise dramatically, from 12 per cent of emerging economies in 2005 to 30 per cent in the decade to 2016.

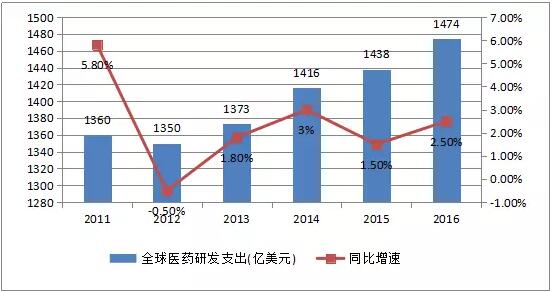

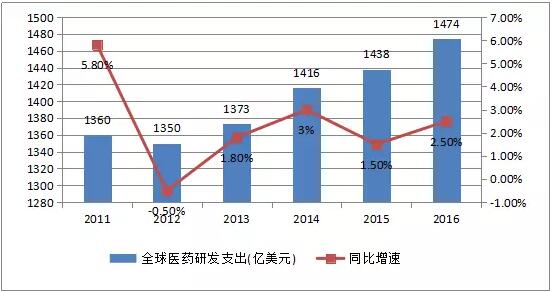

2. Big expenditure on medical research and development.

In 2016, global pharmaceutical r&d expenditure reached us $147.4 billion, up 2.5 percent year on year. The r&d expenditure of pharmaceutical companies at the same time in China reached 607.2 billion yuan, up 27.5 percent year on year. Pharmaceutical industry research and development spending accounted for, continue to remain high in the leading enterprises in the global pharmaceutical r&d revenue proportion is 21%, the domestic pharmaceutical enterprises in the proportion of slightly lower, reached 12%, reflect the characteristics of the pharmaceutical industry, high capital and knowledge intensive.

Of global drug development is gradually warming, which is mainly based on diseases such as cancer, diabetes, cognitive dysfunction and inflammation in the field of treatment the emergence of some new drug molecules, diagnosis and treatment of closely and complement each other, as well as the people less dependence on the traditional business model and other important factors.

3. Pharmaceutical mergers and acquisitions are all over the world.

Is very strong in bio-medicine m&a in 2015 a year, but not the industry is expected in 2016, the pharmaceutical industry's purchase transactions and trading volume has obvious drop, the top ten global biomedical m&a volume of $195.606 billion, down 36% from $303.926 billion in 2015. Pharmaceutical industry in 2016 is the largest m&a German giant bayer's $66 billion acquisition of agricultural giant monsanto, the second is the shire $32 billion acquisition of Baxalta than in 2015 Pfizer's $160 billion takeover of allergan, carlos tevez's $40.5 billion takeover of al and improve the pharmaceutical business is down. The big deal between drug companies is expected to increase in 2017, with companies offering more cash and looking for important assets to expand their product lines.

二、The present situation of Chinese medicine industry.

In 2016, the overall market size of China's drug terminal market reached 1377.5 billion yuan, an increase of 7.6% year-on-year, and nearly double that of 2010. Pharmaceutical industry scale above enterprises not only main business revenue growth year by year, but also the total profit is increasing year by year. According to statistics, the main business income of pharmaceutical industry in 2015 was 268.852 billion yuan, up 9% year on year, which is higher than the 8.2 percentage point of national industrial growth rate. The total profit was 276.82 billion yuan, up 12.2 percent year on year and 14.5 percent higher than the national industrial growth rate. In the sub-industry, the rate of profit growth of biological products is particularly obvious.

Biological pharmaceutical enterprise in China started later than developed countries, but the big but not strong, and the developed countries in the global market share, product competitiveness is a large gap, the United States, the European Union, Japan enterprise international market share has reached 59%, 19% and 19% respectively, and other countries, including China, has only less than 5%.

Five years from 2016 to 2020, we expect China's pharmaceutical market's overall growth at around 7%, in 2018 and 2019, there will be a lot of new drugs, but 2019 years later, because there are a lot of consistency of product evaluation expired, is likely to be brought new challenges to domestic enterprises and foreign enterprises and the change of industry structure.

三、Characteristics of biological medicine industry.

1. High return on products.

The biomedical industry is characterized by high technology, high input, long period, high risk, high yield and low pollution. Bioengineering drugs have a high return on profits. A new biological drugs commonly listed after 2-3 years to recover all the investment, in particular, with the new product, the patented product enterprise, once successful development will form a technological monopoly advantage, returns can be as high as more than 10 times.

2. High industrial technology.

The biomedical industry is also a knowledge-intensive industry, and the high technology content has raised high requirements for the innovation ability of enterprises.

3. Long product development cycle.

Biotech drugs from began to develop into the end product to go through a lot of links: laboratory research stage, pilot production stage, stage of clinical trials (I, II, III), mass production stage, market commercialization stage, and supervise each link strict complex drug administration examination and approval procedures, and product training and market development is more difficult, so the development of a new cycle is longer, general need 8 to 10 years, or even more than 10 years of time, new drug research and development costs at least $1 billion, need high time and money.

4. High industrial risk.

High risk is the development of biomedical products with a greater risk of uncertainty, investment from biological screening of new drugs, pharmacology, toxicology, etc before the clinical experiment, formulation and stability, bioavailability tests until used in human clinical trials and registration listing and after-sales supervision and a series of steps, is expensive system engineering. Failure in any of the links will lead to failure, and certain drugs have a "duality" that may result in adverse reactions in the course of use and need to be re-evaluated. In general, the success rate of a bioengineered drug is only 5 to 10 percent. It takes eight to ten years to invest between $1 billion and $300 million. In addition, the risk of market competition intensifying, "focuses on new drug certificate and grab market share" is the key to development technology into products, is also the goal of different developers, fierce competition, if preferred by others get medicine certificate or seize market, will be disqualified.

5. Big investment.

Biopharmaceutical is a very large industry, mainly used in the research and development of new products and the construction of medical plant and the configuration of equipment and instruments. Currently, the average cost of developing a new biomedicine in foreign countries is around $1 billion to $300 million, and increases with the difficulty of new drug development (some as much as $600 million). Research and development costs for some of the big biopharmaceuticals companies account for more than 40% of sales. Only one year of research and development by the international pharmaceutical giant Pfizer has exceeded the total amount of all biomedical research and development funds in China, and none of China's biomedical enterprises have entered the top 100.

四、Domestic biological medicine industry space and market pattern.

1. Spatial pattern

At present, China's bio-pharmaceutical industry has formed an industrial spatial pattern of rapid development in the central and eastern regions of the pearl river delta and northeast China, with the core of Yangtze river delta and bohai rim. Yangtze river delta region has the largest multinational operation of biological medicine, in the research and development and industrialization, outsourcing services, international communication has bigger advantage, has gradually formed with Shanghai as the center of biological medicine industrial cluster; With abundant human resources and abundant clinical resources and education resources, the relevant industries in bohai rim region have formed an industrial cluster with strong innovation ability around Beijing. The market economy system of the pearl river delta region is mature, and the market potential is strong. The industrial cluster of bio-pharmaceutical industry developed in the key cities of guangzhou, shenzhen and zhuhai is formed. Chengdu-chongqing economic circle is an important transformation base of biomedical achievements in the western region. The changji region of northeast China is the largest production base of vaccine in Asia. Changzhutan area has a large industrial base of changsha high-tech zone and liuyang biomedical park and other industrial bases. More than 300 pharmaceutical r&d institutions and well-known enterprises have gathered in the wuhan urban agglomeration, and have formed a platform and environment to support innovation and industrialization.

2. Market structure

At present, there are about 3,000 pharmaceutical companies in China, with the top 100 enterprises accounting for more than 60% of the market share. The Chinese pharmaceutical market is becoming more and more concentrated, and the future industry concentration will become more and more obvious. Domestic pharmaceutical enterprise has been in the hospital market sales of the top 20 occupy half of the seats, the top 20 followed by Pfizer, astrazeneca, Yangtze, shandong qilu, sihuan pharmaceutical, Shanghai fosun, sanofi, jiangsu hengrui, koren, zhengda shine, bayer, prescription, novartis, roche, ambitious and MSD, China pharmaceutical corporation, nolato,, step length pharmaceutical and novo nordisk.

Now from the hospital market top 20 best-selling products, foreign products are numbered, only four now, other varieties of 16 species are domestic, but the foreign capital enterprise drugs in 2016 year-on-year growth increased, the year-on-year growth rate of domestic companies products are most showed a trend of decline.

五、The field of biomedical industry.

According to a quarterly report this year, the overall profit of pharmaceutical companies was 22.1 billion yuan, a year-on-year growth of 12.3%. After deducting short-term investment income and non-operating income, the profit growth rate of last year was 25.3%, which continued a good upward trend. According to statistics, last year net profit growth rate within 30% of the listed company with 150, net profit growth of more than 30% of the 35, and 58 of the company's net profit is declining, the industry is growing, the limited medical insurance funds will have to determine the efficacy of drugs, to focus on many products face the fate of elimination. In the first quarter of 2017, the overall gross profit rate of the pharmaceutical industry is 30.5%, and the three expenses in the industry are slightly lower. The overall sales expense ratio is 12.5%, the management expense ratio is 6.6% and the financial expense ratio is 1%.

1. Chemical API.

Within the industry niche, as prices fell in the second half of 2016, in the first quarter this year chemical pharmaceuticals sector revenue growth is slowing, overall revenue growth of 13.9%, the overall gross margin was 31.8%, down from 36.0% in 2016.

2. Chemical agents.

The growth rate of the operating income of pharmaceutical preparation companies increased by 14.1%, which showed a small increase trend. Under the situation of the basic stability of growth, the expansion of external expansion in previous years has been enhanced and the overall income scale of the industry has been accelerated. At the same time, the overall gross margin of the industry has increased slightly, while the gross margin of the sector is 46.1%. Taking into account the current strong promotion of the two-ticket system and the tax reform, the income growth of the pharmaceutical preparation sector will be greatly increased in 2017.

3. Biological products

The interior of biological products is two heavy days. Biological products include recombinant gene drugs, blood products, vaccines and other areas of greater difference. In the field of recombinant gene drugs, insulin and growth hormone are still at a high speed of 20% to 30%. In addition, interferon and partial multi-section drugs are under increasing pressure. After the release of price control in 2015, the performance of blood products was fulfilled in the 2016 bidding, and the majority of enterprises in the vaccine industry suffered a decline in revenue and profits.

4. Pharmaceutical business

The concentration degree of the pharmaceutical industry is increasing rapidly, and the net profit is maintained at a high growth rate of 20% to 30%. Medicine circulation, the wholesale side benefit from two votes, high-value consumables, IVD specialist dealers also through rapid elimination and mergers and acquisitions by small companies such as packaging, chaining rate increase in the retail market, revenue growth is higher than the growth of the industry.

5. Medical service

The medical service industry is in a booming growth stage and the revenue scale continues to grow rapidly. Due to A shares less medical service target, many company belongs to the cross-industry business, medical services in their income is low, ophthalmology, dental, medical and other fields, A total of only nine companies belong to the real medical service company. The company's overall revenue growth was 45.7 percent.